trust capital gains tax rate uk

Australia maintains a relatively low tax burden in. Income taxes are the most significant form of taxation in Australia and collected by the federal government through the Australian Taxation OfficeAustralian GST revenue is collected by the Federal government and then paid to the states under a distribution formula determined by the Commonwealth Grants Commission.

2021 Trust Tax Rates And Exemptions

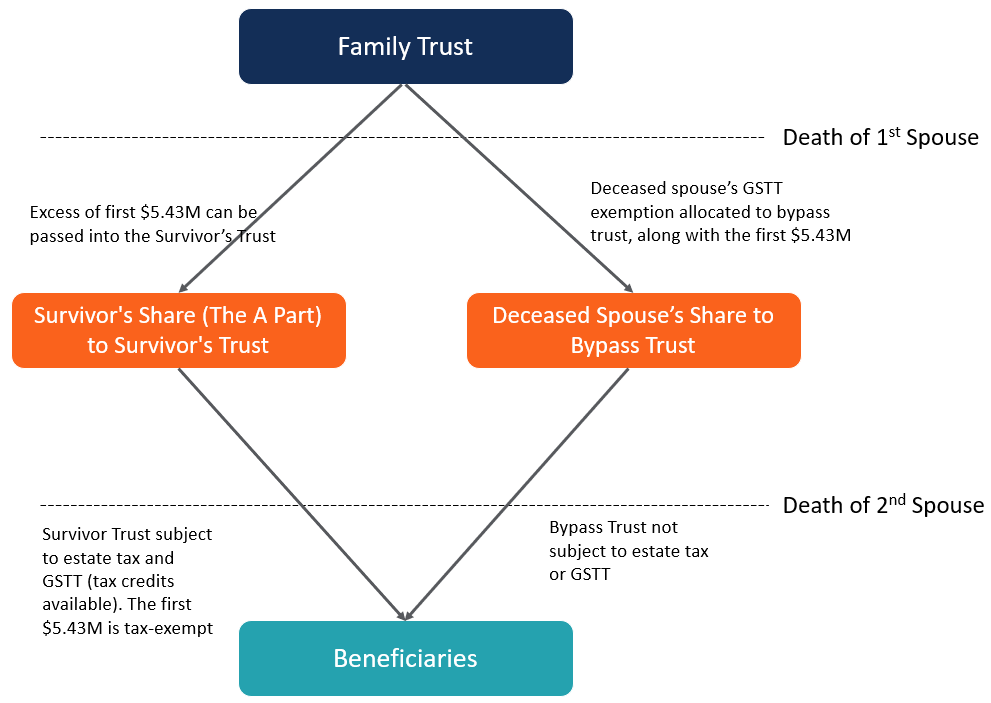

A B Trust Overview Purpose How It Works Advantages

Reasons Why Financial Advisors Should Partner With Trust And Estate Attorneys When Creating A Client Plan Estate Planning Homeowners Insurance Home Buying

How To Tax Capital Without Hurting Investment The Economist

Capital Gains Tax What Is It When Do You Pay It

Owning Gold And Precious Metals Doesn T Have To Be Taxing

Tax Advantages For Donor Advised Funds Nptrust

12 Ways To Beat Capital Gains Tax In The Age Of Trump

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

National Edition Alter Ego Trusts The Answer To Probate Fees Manulife Investment Management

Which Bucket Should Retirees Tap First For Their Heirs Sake T Rowe Price Investing Investment Accounts Need Money

Using A 1031 Exchange To Turn A Rental Property Into A Primary Residence Property Rental Property Property Investment Uk

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Is A Revocable Living Trust Right For You Job Interview Questions Revocable Living Trust Estate Planning

Uk Capital Gains Tax For British Expats And People Living In The Uk Experts For Expats

Reit Investments Tax Implications In India Real Estate Investment Trust Investing Reit